Support for Widows

Everyone can be great because everyone can serve.

Martin Luther King Jr.

The Struggles of Widows: Facing Challenges Alone

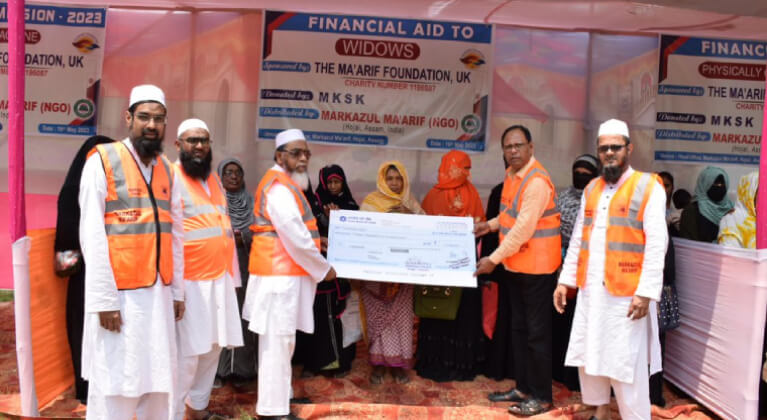

We realized, widows often find themselves burdened with the daunting task of single-handedly providing for their families. Stripped of their family support; these vulnerable women face immense challenges in meeting the basic necessities of life for themselves and their children. At our charity; we recognize the immense struggles faced by these widows and are committed to offering them a lifeline through our Financial Support for Widows program.Financial Support for Widows: Providing a Lifeline

The widows we support are in dire need of financial assistance to navigate their daily lives with dignity and honor. With limited or no income; they find it nearly impossible to afford even the most essential items such as food, clothing, medicines, educational expenses for their children, and household expenses. That is why we step in to provide them with a monthly financial support of £30; ensuring that their basic needs are met and giving them a ray of hope amidst the darkness they endure.Our Commitment to Widows: Extending a Helping Hand

Your donation to our Financial Support for Widows program has a profound impact on the lives of these brave women. By extending a helping hand; you become their pillar of support, offering them a chance to rebuild their shattered lives and regain their self-sufficiency. With the financial assistance you provide, these widows can secure nutritious meals for their families, purchase essential clothing and medicines, cover educational expenses for their children, and meet the day-to-day expenses that often seem insurmountable.The Impact of Your Donation: Rebuilding Lives and Restoring Self-Sufficiency

But your contribution extends far beyond material support. By offering financial aid, you instill a sense of empowerment and hope within these widows. You help them regain their self-esteem and dignity, assuring them that they are not alone in their struggles. Your generosity allows them to focus on healing and rebuilding their lives, knowing that they have a compassionate community standing beside them.Joining the Mission: Making a Lasting Impact

Join us in our mission to uplift these deserving widows and their families. Your donation, no matter the size, has the power to create a lasting impact on their lives. Together, let us provide them with the support they need to overcome adversity and embrace a future filled with hope and possibility.

£0 of £24,000 raised

Leave a Reply